How the gates closed on Blackstone’s runaway real estate vehicle

In July, Blackstone chief executive Stephen Schwarzman recounted a surprise meeting with an investor in the firm’s $69bn-in-assets private real estate vehicle designed for wealthy individual investors.

The person had approached Schwarzman to tell him the fund, called Blackstone Real Estate Income Trust, or BREIT, was his largest position. “I love you people. This is so amazing. All of my friends are losing a fortune in the market and I’m still making money,” recounted Schwarzman of the meeting on a quarterly earnings call.

In fact, investors were pulling money from BREIT at the time, alarming close watchers of Blackstone. Investors withdrew more than 2 per cent of its net assets that month, according to sources familiar with the matter and securities filings, exceeding a threshold at which Blackstone can limit investor withdrawals.

Asian investors had been pulling cash from the fund during the spring and summer as property markets in the region plunged. Some carried high personal leverage and were hit with margin calls, said two people familiar with the matter. BREIT, the value of which has risen this year, could be sold at high prices to meet the cash calls.

As the selling intensified and moved beyond Asia, Schwarzman and Blackstone’s president Jonathan Gray each added more than $100mn to their investments in BREIT this summer, said a source with knowledge of the matter. Blackstone declined to comment on the purchases.

Blackstone chose to not place any limits on investors hoping to withdraw money from BREIT in July. Though it has always told its investors the product is only semi-liquid, such a move could have sparked fears among investors that they could not easily get their money out. But a growing tide of redemption requests forced BREIT to announce on Thursday it would finally raise “gates” — allowing the fund manager to limit the volume of assets redeemed — through to the end of the year.

The move has sent shockwaves inside Blackstone, tarnishing what has become the biggest engine of asset and fee growth inside the world’s largest alternative asset manager. On Thursday, Blackstone’s shares fell more than 7 per cent and a host of analysts downgraded their outlook on the company over fears that the decision could cause its growth to stall.

“The BREIT outflow bear case is playing out,” said Michael Brown, an analyst at Keefe, Bruyette & Woods. “[We] expect it to remain an overhang on shares in the coming quarters.”

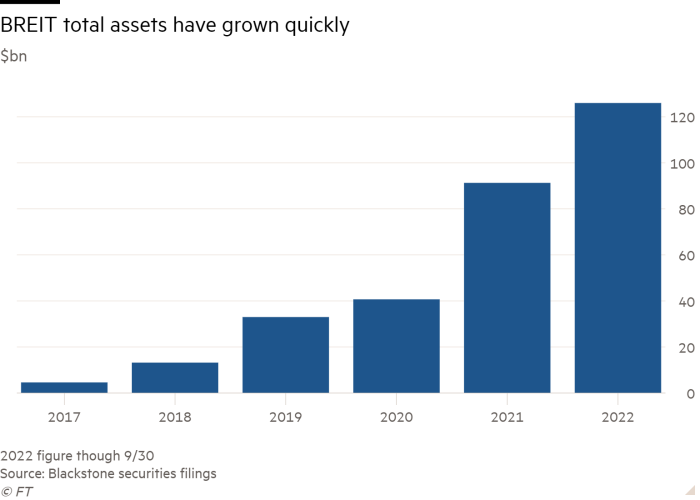

Blackstone created BREIT in 2017 as a way for wealthy investors to gain access to its acclaimed real estate investment platform. Unlike its traditional funds designed for institutional investors like pensions, that came with 10-year lives, BREIT was designed as a “perpetual” fund with no expiration. Interested investors could buy in at the fund’s net asset value and Blackstone would charge a 1.25 per cent annual management fee and a 12.5 per cent performance fee on its annual profits above a 5 per cent hurdle.

Blackstone hired hundreds of sales and marketing staff to sell BREIT and made the fund broadly available to wealth advisers. It even created “Blackstone University,” an online portal where the advisers could be indoctrinated on the fund’s merits.

It pitched BREIT as offering wealthy individuals the same ability as large institutions to diversify away from public markets and receive healthy dividends. However, to do so, they would have to accept giving up some liquidity rights. The fund allows for 2 per cent of total assets to be redeemed by clients each month, with a maximum of 5 per cent allowed in a calendar quarter.

BREIT became a roaring success, drawing in tens of billions of dollars in assets. Blackstone invested the money mostly in logistics and multifamily US residential real estate, where it correctly predicted that supply shortages would propel rising rental income. The portfolio now stands at $125bn in gross assets, which includes leverage Blackstone has used to purchase property.

In 2021, Blackstone launched a similar product designed for debt-based investments called BCRED. Industry peers such as KKR, Starwood and Brookfield have launched funds to replicate Blackstone’s success as they also prioritise winning wealthy individual investors as clients.

“I do have a little bit of non-traded . . . Reit envy,” said Marc Rowan, Apollo’s chief executive, last year, referring to Blackstone. “This has just been amazing. Kudos to the firms that have really gotten in front of this market and have really shown us how much money is out there.”

BREIT has grown to become a significant piece of Blackstone’s overall finances, representing about 10 per cent of its fee-paying assets under management and about a fifth of overall fee-related earnings, according to analysts at Barclays. Since the fund is ostensibly perpetual in nature, analysts have ascribed multiples as high as 30-times fee revenues to the fund’s assets.

As about $100bn poured into BREIT and BCRED in recent years, Blackstone’s market value at times eclipsed that of Goldman Sachs.

This year has proven to be more challenging, as rising interest rates and falling publicly listed property stocks scare some property investors. Over 70 per cent of redemptions from BREIT have come from Asia, the FT previously reported, where regional property markets have plunged.

BREIT’s success also made it vulnerable to investor redemptions. The fund has delivered a 9.3 per cent total return this year, while US listed real estate trusts have declined about 20 per cent. Since the fund repurchases redemption requests at their most recent quarter’s net asset value, it became a rare asset investors looking to raise cash could sell at annual highs.

Wealthy US investors began submitting requests to trim parts of their holdings this fall. Some realised gains on BREIT and offset the taxes with losses on other assets, said sources familiar with the matter. Now that Blackstone has limited withdrawals, investor demand to pull their money from the fund may intensify.

“Our view is that the greatest rate of growth is behind BREIT,” said William Katz, an analyst at Credit Suisse. Katz said the redemptions cast into question the true value of BREIT to Blackstone and will diminish the firm and its peers’ ability to raise money from wealthy investors in the future.

“The ultimate question has to be asked about the efficacy of these products if clients only want to get their cash out,” he said, questioning just how perpetual such capital is.

Investors’ rush for the exits has come before BREIT reported any financial hit from rising interest rates, a slowing economy, or falling property valuations. Critics of the way private vehicles are valued note that the fund has gained this year while more volatile public markets have fallen sharply. Blackstone says its valuations emphasise the underlying financial performance of its properties and not quickly shifting investor sentiment and they have accounted for higher interest rates.

On Thursday, Blackstone announced the $1.27bn sale of a minority interest in two Las Vegas casinos owned by BREIT, which sources told the Financial Times could be used to support the fund’s liquidity. BREIT made about twice its money on the investments over three years and has sold $5bn in assets this year above their carrying values, said the sources. BREIT is considering other asset sales, but insists it will not be a forced seller.

Some advisers believe the limitation on redemptions will stave off any risks of firesales, but they are advising clients to pause on committing to BREIT.

“The gates are one of the features of the investment that actually protects investors,” said Andy Kapyrin, chief investment officer of RegentAtlantic, a registered investment adviser with about $6bn in assets under management.

“I don’t think the liquidity risks are so big that they should book a capital gain to get out. For investors that aren’t in, we are recommending a cautious approach.”

“BREIT has delivered extraordinary returns to investors since inception nearly six years ago and is well positioned for the future,” said Blackstone in a statement.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/O7HV662XA5KU7M7ALPVUWEKOFQ.jpg)